Liquidity is often a term that is thrown around, but a lot of us don’t actually understand or know how it applies to us. In this blog, we run through what liquidity is, how to determine is and why it’s one of five key elements that underpin any investment choice.

Let’s talk about all things liquidity.

Some investments cost you in time and often money to exit. In other words, they are not what we would call liquid investments.

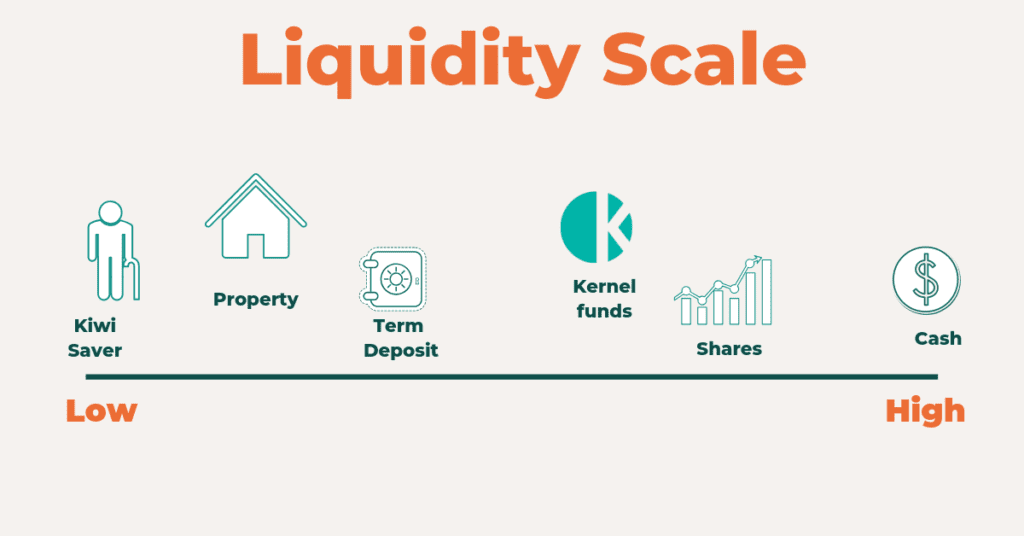

Put simply, liquidity is how quickly an asset can be converted to cash and at what cost. You can “firesale” almost any asset, depending on the discount you are willing to accept. Cash is universally considered the most liquid asset.

So, what about other assets?

Property, for example, can take months to sell and settle with many costs involved; agents fees, advertising and preparation costs. Businesses or shares in unlisted companies are the same; often requiring a business broker and a lengthy negotiating period.

To access any KiwiSaver funds you must meet strict legislative criteria, unless you are over 65.

Bonds, debentures, and notes (fixed interest investments) can be sold if you can find a willing buyer, which is sometimes easy if listed and popular and sometimes not.

Term deposits and even some restrictive savings accounts charge you a break fee or require a period of notice before you can access your money.

Shares, ETFs and listed managed funds have much greater liquidity, as they can generally be sold and settled within a couple of days – but brokerage or trade fees usually apply!

Why should you care about liquidity? Good question.

Having some liquidity in your finances is important for those unexpected events – something we call an emergency fund. Bad news when getting your WOF? Unforeseen medical event? Urgent need to travel to see a family member? These things require cash, available stat.

We recommend you have a small savings balance set aside as your emergency fund, earning on-call interest through a savings account or similar.

You don’t need all your financial assets to be super liquid though – in fact it’s a good idea to not have easy access to everything. Impulse purchases are real, as are emotional reactions to market movements.

Hey, you’re only human.

Having some assets that are less liquid than cash can help ensure you’re not your own worst enemy.

The Kernel funds are available to withdraw each Wednesday and have no transaction fees involved: they are liquid but not available immediately.

Your redeemed amount from the fund shows in your wallet on Fridays. Meanwhile all money in your wallet can be withdrawn overnight (business days) to your bank account. Thinking about Suzie again (who’s Suzie?), if she finds a house to buy, she needs to be able to access her funds pretty quickly to bid at an auction and pay the deposit.

When choosing investments for your own goals, make sure you’re clear on how quickly you can convert the assets into cash and be comfortable with the answer.