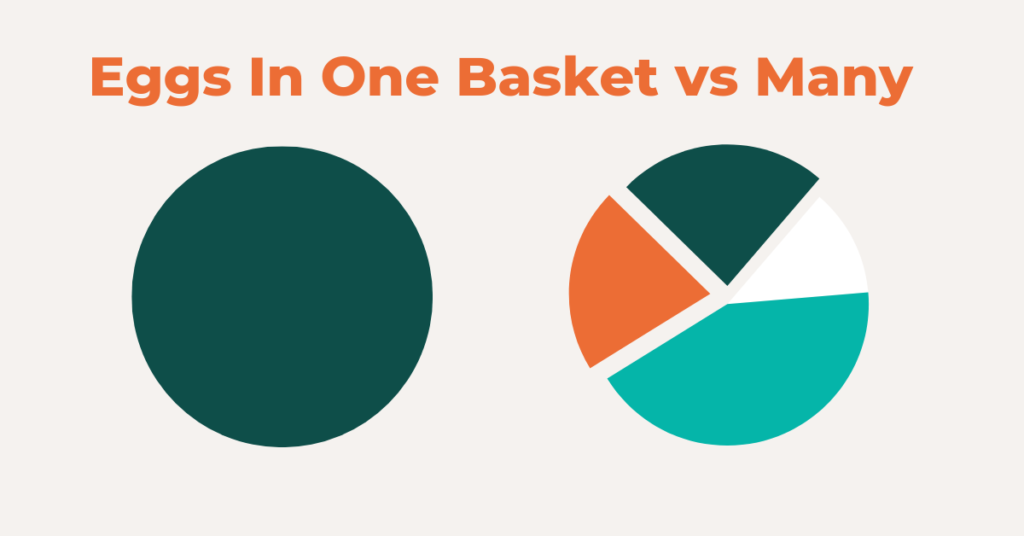

We’re sure you’ve all heard the eggs in one basket analogy – drop the basket and all eggs will crack.

Diversification means building an investment portfolio that’s made up of many different types of investments that behave in different ways.

This can be within an asset class or between asset classes. For example cash, bonds, property, and shares – having a concentration can lead to high correlation. Woah, hold up – let’s just break that down.

Concentration means lots of something – so having your investments in ALL shares or MOSTLY property. Whatever the asset class, having lot’s of just one type of asset means you are highly concentrated in that asset.

Correlation in its simplest form means a relationship between two or more things. In the case of investments, a high correlation means your investments may be similarly impacted by a specific event or change in the market. Uh oh – that doesn’t sound good.

It can be great if it is a positive impact, but the flipside is an event that negatively impacts your entire, closely correlated portfolio.

This is why you need to think about diversification.

Anyone can agree that you wouldn’t want one single event to have a significant impact on your total investment.

So how does this work practically?

Some money in each of the four major asset classes is sensible. Within those classes, spread it around. As an example, if you own your own home and your next financial goal is to buy an investment property, don’t buy a house in the same street.

The same logic applies to shares, where Modern Portfolio Theory (now 60 years old!) says 12-20 companies across industries will spread the risk of concentration. Choosing 12-20 companies can be a lot of work, hence the rise of managed funds as a way to reduce costs and effort required.

This is where index funds come into play, as they provide investors with broad diversification with just one purchase. Even better, you can get that diversification from the smallest of investment balances – it’s accessible to all.

Psst: diversification can’t get rid of all the risk of investing.

Nothing can do that. There will always be certain risks — like a recession, changes to regulatory rules or a GFC. But it’s definitely the place for any investor to start.