A question we are often asked is…

Why did we build the NZ 20 Fund and not a NZ 50 Fund?

After all, the NZ 50 is considered the benchmark for New Zealand; it’s on the news each night and in papers each morning.

There are a couple of factors that swayed us in the direction of creating the NZ 20 Fund, rather than yet another variation of the NZ 50.

Through our research and philosophy to bring international best practice and innovation to New Zealand, there is method to our madness.

Simply put, we strongly believe the NZ 20 is better.

Here’s why…

When investing in an index fund, the choice of index itself is more important than the fees the fund charges, because ultimately, it is the index design and structure that will determine what sort of performance you can expect.

It’s important that, as an investor, you understand what the index invests in, how it invests and where it may sit within your portfolio.

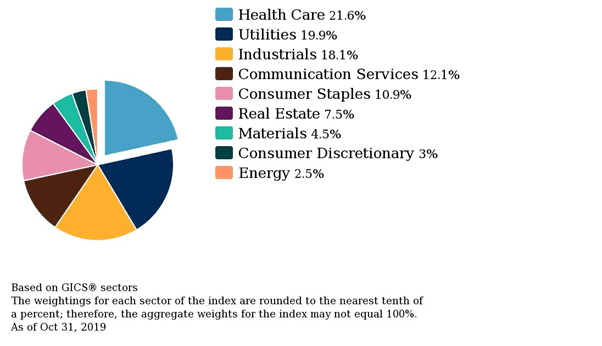

When researching the NZ market we found that the S&P/NZX 20 index had a unique combination of sectors (think power companies, transport and ports and healthcare).

This unique combination of sectors, driven by the number of companies in the index, meant that when a sector wasn’t performing as well as the rest of the market it had less of an investment in that sector, and when a sector performed well it had more of an investment in that sector.

Overall performance

This has resulted in the S&P/NZX 20 index outperforming the S&P/NZX 50 over 1, 3, 5 and 10 year periods by well… A LOT! Over the past 10 years it outperformed by 1.43% per annum.

What does that mean for you?

If you had access to our NZ 20 Fund 10 years ago (in 2009) and invested $1,000, you would have been $499 better off than having invested in an S&P/NZX 50 index fund.

This is a 33% better return! And before you accuse us of cherry-picking “good dates”, this holds true for all common reporting intervals (1Y, 3Y, 5Y) over the last 20 years.

Why is that?

There are also other theories and research that S&P Dow Jones Indices have helped us investigate, but one that we favour is that many of the top 20 are well covered by foreign analysts and meet investment criteria of offshore investors.

Therefore it attracts more foreign investment and the NZ 20 is a stronger view of New Zealand’s attractiveness in the world, without the additional cost and effect of the other 30 companies.

The S&P/NZX 20 also has a 97% correlation to the movement of the S&P/NZX 50, so you are not accepting additional volatility by using it instead.

Got some thoughts on this of your own? We’d love to hear them!