There’s no denying that the popularity of index funds is continuing to grow both in New Zealand and overseas as investors shift their strategy from stock picking to indexing. In fact, according to Ernst & Young, the market share of index funds of the global equity market rose from 14% in 2011 to 31% in 2020. So, it’s no surprise that we find many investors asking which fund is most suitable to invest in.

Recommended by Warren Buffett, many US-based investors turn to S&P 500 index funds. This is perhaps why it’s the most popular type of index fund in the US. What many New Zealand based investors do not know is that S&P 500 index funds may not be their most suitable investment option. Why? Read on to find out.

What is the S&P 500 index?

The Standard & Poor’s 500 Index, or simply S&P 500, is a capitalization-weighted stock index tracking the performance of roughly 500 large-cap U.S. companies. 505 to be specific. The S&P 500 is often referred to as the best gauge of the US economy since its constituents make up 80% of the US equity market cap and span across all market sectors.

There is a common perception among investors that the US market is the safe harbour with long-term growth potential. So, if you would like your portfolio to grow with the US economy, you should invest in this broad well-diversified index fund offered by many providers.

Why are S&P 500 index funds so popular?

Since its inception in 1957, the S&P 500 index has faced countless downturns and market crashes. However, given enough time, it has always been able to recover, earning an average return of around 10% per year over most long-term periods. Both retail investors and investment experts marvel at this robust performance.

In fact, Warren Buffett repeatedly claims, including during the 2020 Berkshire Hathaway shareholder’s meeting, that “for most investors, the best thing to do is to own an S&P 500 low-cost index fund”. No wonder why S&P 500 index funds are so loved by investors when the Oracle of Omaha recommends it!

Undoubtedly, consistently buying Vanguard S&P 500 ETF or iShares Core S&P 500 ETF through thick and thin can be a good option for many US investors. However, if you are a New Zealand tax resident, you might need to think twice about putting your money in S&P 500 index funds. Let’s discover the rationale behind this.

The number of stocks – is more always better?

One of the reasons why people want to invest in S&P 500 index funds is that its size of over 500 companies is believed to offer good diversification. Diversification means that different stocks in different sectors and industries respond differently to market factors. This ensures that all stocks do not go down in value at the same time and thereby reduces the probability of severe losses during recessions or crises.

However, we should bear in mind that the more companies we add to our holdings, the more underlying costs and administrative record keeping is required. Hence, the question is how much diversification do we really need?

So, how much diversification do you need?

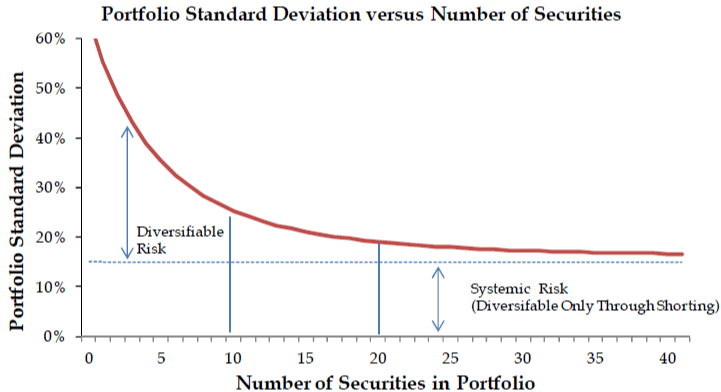

Research on the ideal number of stocks to make a diversified portfolio has been extensively done over the past three decades. While results have not yet been settled, one common thing is that these studies often focus on the minimum – not the optimal – size needed for a well-diversified portfolio. Depending on which markets and time periods are examined, this minimum can vary from 20 to 100 stocks.

For instance, one of the most recent studies on the subject found that over the period from 1975 to 2011, the number of stocks needed to reduce 90% of diversifiable risk, on average, is about 55 for the US market. In times of financial distress, the figure can increase to 100 stocks.

For the U.K., Japanese, Canadian and Australian markets, other research suggested it can be as high as 86, 97, 39 and 81 stocks, respectively. Nevertheless, the results only cover domestic equity investment, leaving the international diversification untouched.

As the chart below illustrates, there is diminishing returns to the addition of stocks to a portfolio, so while the first 20 reduce that risk, once holding over 40 (assuming they are across country, sector and style) the benefit is much smaller.

Source: “Risk, market sensitivity, and diversification”. Financial Analysts Journal, 51(1), 84-88.

So, beyond the sweet spot where investors can reduce 90% of diversifiable risk, adding stocks to your portfolio does not help mitigate portfolio volatility in any significant way.

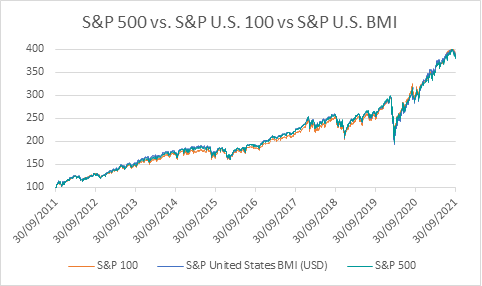

This can be demonstrated by the correlation of returns between the Top 100 stocks of the S&P500, the S&P500 itself and the S&P United States BMI, (all 3,293 listed United States Companies) is 99.9%. As evidence of this, Chubb being 101st largest company, represents only 0.20% of the S&P500.

Diversification isn’t just about the number of stocks

Often investors read that a fund has a certain number of stocks and immediately think it equals more diversification. But this isn’t always the case. That diversification may be concentrated in a country, sector or style (e.g. early stage, value, thematic) and even in total world indices you don’t get everything.

Looking at a couple of indices examples that offer exposure to multiple large and mid-cap companies across various markets, we can see that there are 1,561 in the MSCI World Index and 11,801 in the S&P Global Broad Market Index (BMI).

Whilst it can be tempted to want to own every stock in the share market with the intention of maximum diversification, the reality is that even the largest, broadest indices don’t capture every listed company in the world and have various criteria such as sufficient liquidity, minimum size and which exchange listed on as some smaller stock markets are excluded.

The size of companies within an index matters too

Given almost all broad indices are market capitalisation (cap) weighted, the size of the company within any given fund is likely to influence the performance of that fund. Stocks with a larger market cap have a higher weighting and any movement in their share prices will have a larger impact on the index performance.

On the other hand, many smaller companies that are just a fraction of the size of larger companies (e.g. Apple), won’t have an effect on the overall performance of the fund. The chart below illustrated the difference in index performance between the US100, S&P500 and the US BMI of all 3293 US listed companies. Basically the same!

This leads us to one of the main reasons we chose to offer and track the S&P Global 100 index rather than simply opting to offer access to the S&P 500 index.

Don’t forget about diversification across markets

Often considered less, diversification across markets is just as important as diversification across stocks. Certainly many large US companies have global operations, but there are also great companies not listed in New York.

All 505 holdings in the S&P500 are US listed companies, whereas the Global 100 Index can offer exposure to companies not listed in the United States. Another reason we decided to offer the S&P Global 100 index as against just a fund with US listed companies. In fact, to be included in the S&P Global 100 index, companies must have operations in all three major continents, have their assets and have revenue streams spread around the world. This globalisation requirement is an additional dimension of diversification.

The S&P Global 100 offers roughly 73% exposure to US listed companies, plus an 18% allocation to Europe, 7% to United Kingdom and 2% to Asia/Australia (as of 30 September 2021). These large, global companies and brands together make up an index of USD 14 trillion in market cap.

The point is: why just concentrate all the portfolio on those listed in New York on the NYSE and NASDAQ via S&P 500 and miss out some mega global names like Nestle, LVMH-Moet Vuitton, Toyota and Samsung Electronics.

How about diversification between sectors?

In terms of sector diversification, the S&P Global 100 Index has a broader sector mix than that of the S&P 500. The top 10 holdings span across I.T., Consumer Discretionary, Communication Services, Health Care, Consumer Staples, and Financials, as of 30 September 2021.

Despite accounting for almost 30% of the index’s market value, the ten biggest stocks in the S&P 500 cover only four sectors, namely, I.T, Consumer Discretionary, Communication Services and Financials.

For more on diversification between markets and sectors, read our blog on diversification or check out our recent webinar.

In investing, you get what you don’t pay for

One critical factor to consider when choosing index funds is the fees that we must pay for. In NZ, an unlisted index fund and a passively managed Exchange Traded Fund (ETF) are not the same thing.

ETFs are funds in which you can buy and sell units on the share market. Hence, besides the management fees paid to fund managers, there will be other trading costs incurred. For example brokerage commissions, bid/ask spreads, and foreign exchange fees, when buying or selling ETF units.

By comparison, with unlisted index funds, you purchase units directly with zero transaction fees. You receive the full value of a unit, not a premium when buying or discount when selling to the facilitator.

Moreover, listed investments are not always as tax efficient as some unlisted investments. Thanks to unclaimed tax benefits, higher dividend tax rates and dividend drag, NZ ETFs can often cost NZ investors more than they think. More on this here.

So, what are the options for NZ investors?

Currently in NZ, if you want to invest in S&P 500 index funds, your only options are either New Zealand Stock Exchange (NZX) listed ETF or ETFs listed overseas.

However, if you want to track the S&P Global 100 index, you can invest in Kernel’s unlisted index fund. The Kernel S&P Global 100 was launched on 15 July 2020, and with our product design, there are no brokerage, buy-sell spreads, or foreign exchange fees. For those contributing regularly to a portfolio, these can often make a large difference on the total cost of ownership.

Remember, more stocks doesn’t necessarily mean more diversification

Now that you’re armed with knowledge around a few key differences between the S&P Global 100 and S&P 500, we’ll leave you to make the decision. The bottom line is that with Kernel’s S&P Global 100 fund, your portfolio is well-diversified across both sectors and countries. Plus, it’s also being cost-effective compared to other listed investments.