Do you have savings in a bank account whilst interest rates are 0%? Yeah, us too. How should we be investing when our savings are essentially earning nothing, or worse, going backwards? That’s the decision most Kiwis are facing with their hard-earned cash right now. So what options do you have to invest when interest rates are 0%? Let’s discuss!

Why are interest rates 0%?

Before we look at how to invest when interest rates are 0%, it’s worth looking at why interest rates are that low.

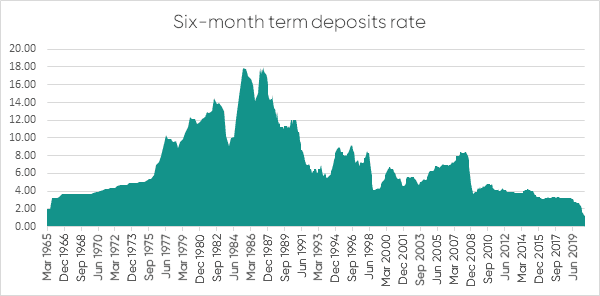

Falling interest rates isn’t a new phenomena (negative interest rates are though!), in fact it’s been a 40-year macroeconomic trend.

Focusing on recent memory, interest rates have been cut on the back of two major economic shocks; the Global Financial Crisis and COVID-19.

Let’s look at it from the banks perspective. When COVID-19 struck, lots of people rushed to put their money in a safe place like a savings account. Banks pay you money to keep your money there because they need cash to do what banks do; lend money out to homebuyers and businesses. As the supply of money available to banks increases, the less they are willing to pay you for your money.

Also whilst Covid was going on, The Reserve Bank of NZ lowered interest rates, simultaneously increasing the money supply.

This helped struggling businesses stay afloat by lowering their cost to do business, and encouraged spending, lending and borrowing. While this was a good outcome for those hit hardest during this crisis, your savings account has been an unfortunate casualty.

Which interest rates are 0%?

When we talk about “interest rates” we’re referring to the official cash rate (OCR). OCR is an interest rate set by the Reserve Bank of New Zealand which defines the wholesale price of borrowed money. This is the rate the Reserve Bank (wholesale bank) charges other banks to borrow money for one day. In turn, this directly affects every other interest rate a bank will offer or pay their customers.

For example, mortgages, loans, credit cards and what they will pay for term deposits and savings accounts. The Reserve Bank reviews the OCR, which is currently just 0.25%, eight times a year.

Central banks are mandated by the government to manage the rate of inflation and increasingly other economic measures such as employment.

By making changes to the OCR they try to regulate the economy and directly affect the money supply. If a central bank cuts the rate, it will be cheaper to borrow money. There will be more money available, at a lower price, which tends to make some people spend more. Just look at the housing market in NZ right now!

On the flip side, when the central bank raises the rate, it gets more expensive to borrow. This means there will be less money circulating, the price to borrow will be higher and people tend to save more.

The biggest challenge facing central banks today is that interest rates have fallen so far that they’re at zero and in some countries negative!

Ongoing cuts to interest rates are unlikely, as further cuts have a diminishing impact on stimulating growth. Instead, we can expect to see governments revert to other means to drive economic growth and prosperity. This is called fiscal stimulus. Most often it involves activities such as infrastructure spending programs in order to create jobs and stimulate the economy.

Should you even bother with a savings account?

Everything in investing starts with assessing what your goals are. Ask yourself: what’s this money for? If it’s savings you can’t afford to lose in the short term, a savings account is still a great idea.

Of course, the realities of saving versus investing cannot be oversimplified. There are many personal factors to consider, like whether you have an emergency fund or a near-term big-ticket purchase, like a home or new car.

There are many good reasons for favouring greater savings in the present, even if it means earning less. However, savings at the exclusion of investing can prove problematic over the long term.

How do interest rates affect shares and bonds?

The relationship between interest rates and financial markets is complicated and not always predictable. First, there are three key asset classes to consider: cash, bonds and shares.

Cash (like savings accounts and term deposits) have the least risk and therefore the lowest returns. Shares have the highest risk of the three, so they need to offer the highest returns to be attractive. Bonds need to provide returns above cash, with less risk than shares.

Investing in shares isn’t as risky as you may perceive, as long as you have a diversified portfolio across a range of companies, sectors and have time on your side.

When interest rates for savings accounts are low, saving becomes much less attractive. Your real returns are negative and no longer provide the income investors require. This means you need to consider investing over saving.

This can result in the price of these assets increasing, as there is more demand. If the price of shares increases without their fundamentals (i.e. the expected profits of a company) changing, the returns you can expect are lower.

So low interest rates are a bit of a double-edged sword. When interest rates are cut, the share markets will get an immediate boost. However, lower interest rates also make your expected rate of return lower in the long run.

What am I supposed to do with my money right now?

A key investing principle is that if you want a return on your investment, you need to take some risk. That’s where investing in shares comes in. If you have time on your side, investing in a diversified portfolio of shares can result in a greater return. Likely much more than cash! But due to lower interest rates, these returns may be lower than what they have been in the past. That’s the world we live in right now.

In a low interest rate environment, are there any investing tips to keep in mind?

We all know diversification is a key investing strategy and the pandemic has actually amplified its importance.

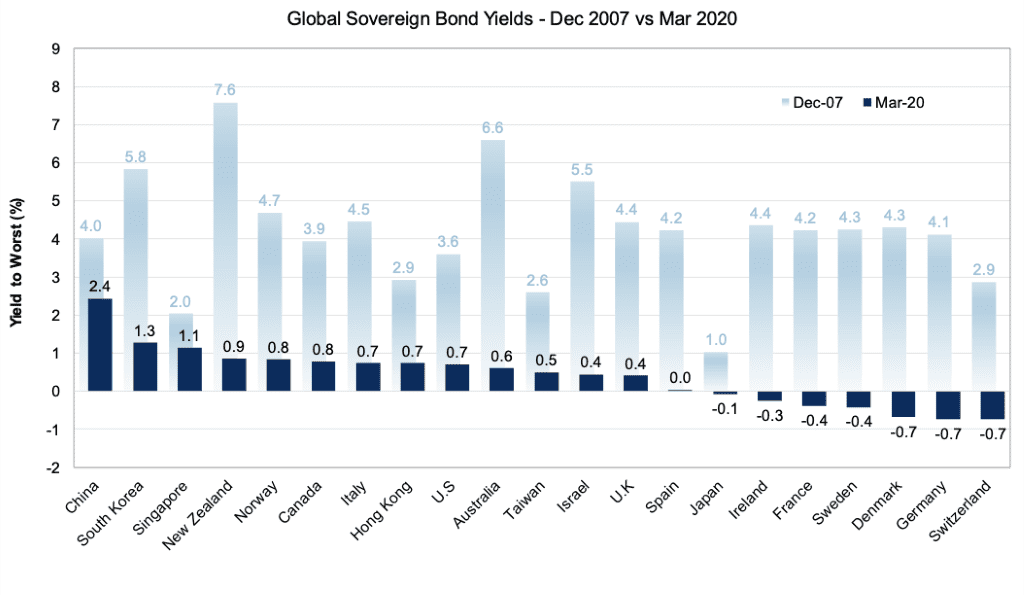

However, the low interest rate environment, plus the increasing chances of an interest rate rise, means investing in bonds may no longer provide the return benefits that investors expect.

Bonds in an investment portfolio aren’t generally viewed as return enhancers but rather seen as volatility dampeners. If your time horizon is short, as in you are truly going to spend that money soon at a fixed point in time, then it makes sense to use bonds. Otherwise, it’s a speed limiter on your wealth.

If you’re investing for a long-term goal (10+ years) you shouldn’t be too concerned about market volatility because you’ve got the time to ride it out. This is why, when we hear from people in their 30s saving for their retirement (a 25+ year time period), having an exposure to bonds just doesn’t make logical sense.

The health crisis has also demonstrated that a lot of governments and governmental systems around the world are under strain, even in places we thought were stable.

At the same time, not all sectors have been impacted equally. While tourism and hospitality have been hit hard, technology companies have boomed. Making sure you are globally diversified is more important than it’s ever been.

So you’re telling me…I’ll lose money long term in cash, bonds may not provide the diversification I need, share markets may not provide as high returns as we’ve seen. Not the best news. So should I be trying to turbocharge my portfolio with some alternative investments?

Not quite.

While it’s tempting to chase quick returns and invest in hot tips from friends or the internet, our general financial guidance hasn’t wavered.

That means putting the majority of your money in riskier assets (i.e. investing over saving) and allowing compounding to get to work for you. Investing in a low cost portfolio of shares, ideally through an index fund, can offer attractive returns over cash.

You can consider bonds and cash for those short term money needs, but may want to think twice about having too large of an investment in these asset classes in this environment.

If you do want to gamble with speculative investments (we see you bitcoin) or fancy yourself a ‘trader’, make sure it is with a small fraction of your portfolio that you are happy to lose if it goes to zero.

Finally, there’s the really basic stuff that is probably more important than any investment decision you make. Whether interest rates are 0% or 5%, remember…

Save more than you spend. Minimize the amount that you pay in fees and taxes.

And remember to enjoy your day to day life, don’t check your investments too regularly. A simple set and forget strategy is the most successful approach to investing.